The long saga of approving spot BTC-ETFs, whose intense phase lasted over two months, concluded with a statement from the SEC approving all applications. Despite the weak reaction of the BTC/USD quotes to this event, a significant increase in trading activity and renewal of absolute highs should be expected in the medium and short term. However, there are reasons for concern regarding the short-term prospects.

Apart from the classic overheating of Bitcoin and the fact that the absolute majority of BTC coins are in profit, fundamental market sentiments have declined. This is primarily due to changes in priorities and expectations regarding the Federal Reserve's policy. There is a high probability that investors and traders have overestimated their expectations, which may now lead to the start of a local correction, including in the cryptocurrency market.

Inflation Data

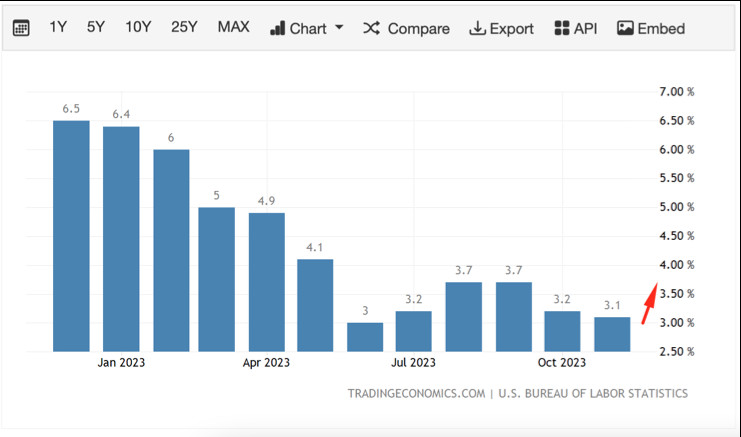

Today at 13:30 GMT, a publication of a key macroeconomic factor will take place, which will significantly influence the Fed's decision at the end of January. Investors' opinions are divided regarding the report reflecting the change in the consumer price index for December 2023. Traders and market makers suggest that inflation in the USA may accelerate relative to November, returning to the 3.2% mark. This could be a reason that prompts the Fed to delay the start of easing monetary policy.

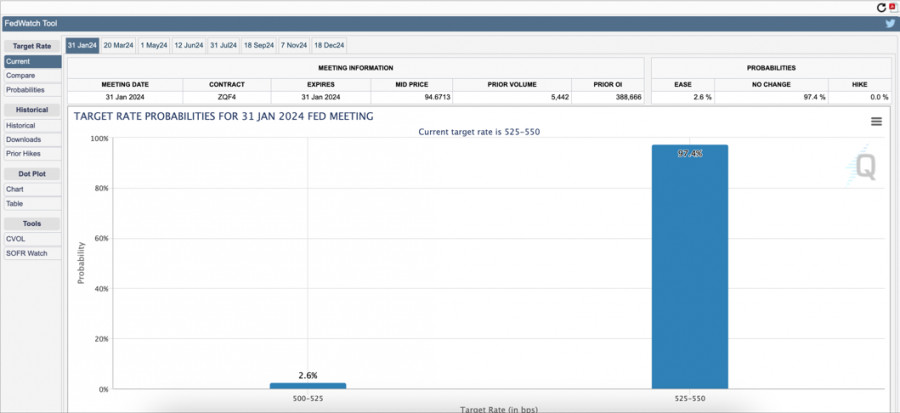

According to the CME FedWatch Tool, only 2.6% of investors and traders are confident that the Fed may lower the interest rate at the meeting on January 31st. Meanwhile, another pause in raising the rate is no longer perceived by investors as a positive signal, as the markets expect the beginning of a cycle of easing monetary policy. Considering this fact, Bitcoin and other investment assets are under increased pressure from sellers.

However, there is every reason to believe that the situation may change if inflation falls below the 3.0% mark, restoring hope for a faster start to the Fed's easing of monetary policy. The current CPI forecasts are among the most uncertain, so heightened volatility is expected in the markets. Considering the start of BTC-ETF trading, a real storm is expected in the Bitcoin market today.

First Day of BTC-ETF Trading

The SEC published a document stating that the regulator approved applications for the launch of spot BTC-ETFs from ARK, 21Shares, Bitwise, BlackRock, IBTC, Fidelity, Franklin, Grayscale, Hashdex, Invesco Galaxy, VanEck, Valkyrie, and WisdomTree. Today, January 11th, marks the start of ETF trading, so it is quite likely that liquidity volumes and volatility in the BTC market will significantly increase. From today, banks, investment and pension funds, and other institutional investors can invest in Bitcoin.

Despite the overall positivity, SEC Chairman Gary Gensler noted that the approval of the ETFs does not change the regulator's attitude towards other cryptocurrencies and their status. The Commission will also investigate any fraud or manipulation in the securities markets, including BTC-ETFs. Concluding, Gensler remarked that despite the approval of spot BTC-ETFs, the regulator does not support or endorse Bitcoin as a cryptocurrency.

BTC/USD Analysis

The last few days have been maximally volatile for Bitcoin, leading to the liquidation of traders' positions. By the end of yesterday, the asset tested a new high at $47.6k, then dropped to $44.3k. Bitcoin ended the trading day above the $46.5k level. As of January 11th, the cryptocurrency is trading near the $46.3k level with daily trading volumes around $52 billion.

Despite the conclusion of the saga with the approval of spot BTC-ETF, the market remains highly volatile, increasing the chance of price manipulation by market makers. Additionally, the positive impact of the approval of the spot crypto product may be overshadowed by the resurgence of inflation in the USA, pushing expectations for the start of monetary policy easing to the second half of 2024.

Conclusions

Leading crypto analysts and financiers have called the approval of spot BTC-ETFs a turning point for the crypto economy. The saturation of the market with liquidity will reduce its volatility and susceptibility to manipulation, which, in turn, will significantly increase its investment attractiveness. Also, the BTC halving will begin in April, providing additional support to the asset's quotes, leading to significant growth in capitalization and renewing its high above $70k.