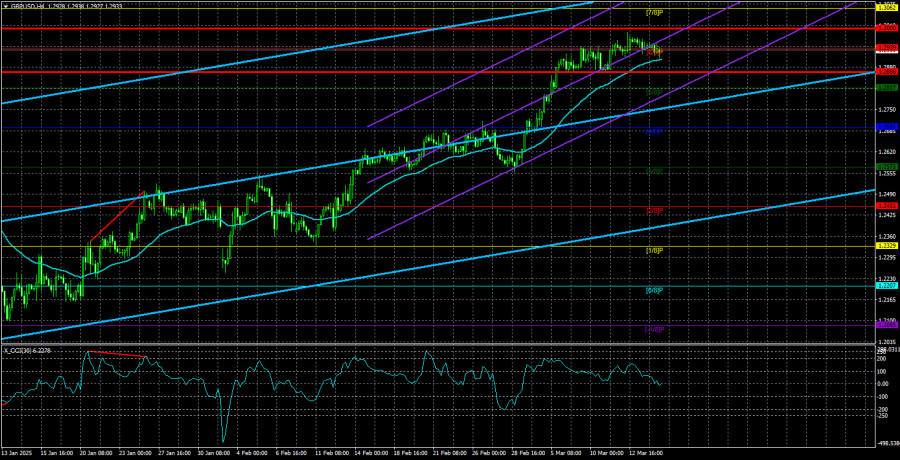

The GBP/USD currency pair completely stagnated on Friday. The chart below clearly shows that there was significant volatility during the first three days of the week before last when the dollar was plummeting, but then the market calmed down. While the British currency's growth has not ceased, volatility has dropped to minimal levels. As a result, regardless of the direction in which the market moves in the near future, trading is challenging, even on a 5-minute timeframe.

On the daily timeframe, the current increase in the British currency still appears to be a correction. We maintain that there are medium-term and long-term downward trends in place. Therefore, to claim that we expect a continued decline in the US dollar would be misleading. Conversely, saying that the US dollar cannot fall further would also be incorrect. Unfortunately, the current technical indicators, as well as the macroeconomic and fundamental landscapes, do not provide clear guidance on how the situation will develop. It is evident that the pair's movements seem disconnected from both technical analysis and fundamental factors. Two weeks ago, the market began to sell off the dollar en masse in response to the American president's imperial ambitions, but what comes next? Will the market now react solely to Trump? How much influence will he have?

On Friday, another set of concerning data was released in the UK. The GDP growth rate for January showed a decline of 0.1%, while traders had anticipated a growth of at least 0.1%. Industrial production also experienced a significant drop, decreasing by 0.9%. As a result, we have not received any positive macroeconomic data from the UK, and it seems unlikely that we will anytime soon. The market continues to overlook this news in favor of the dollar.

This week, both the Federal Reserve and the Bank of England will hold their meetings, with expectations that interest rates will remain unchanged at 4.5%. This means that neither bulls nor bears hold a distinct advantage in the market, and macroeconomic data are being disregarded. However, the focus will be on what Andrew Bailey and Jerome Powell say during these meetings. Powell frequently addresses the public, giving us a clearer understanding of the direction in which the US central bank is heading. In contrast, the BoE remains somewhat of a "dark horse," as Bailey speaks infrequently. In December, he mentioned plans for four stages of monetary policy easing in 2025. However, considering the numerous events that have transpired in early 2025, those plans may need to be re-evaluated.

What difference does it make? If the BoE's stance becomes a bit more hawkish, it could lead to an increase in the pound's value, which is already appreciating regardless of the reasons behind it. Conversely, if the Bank's stance remains unchanged, the pound may not react at all, as the market seems disinclined to buy dollars and sell pounds.

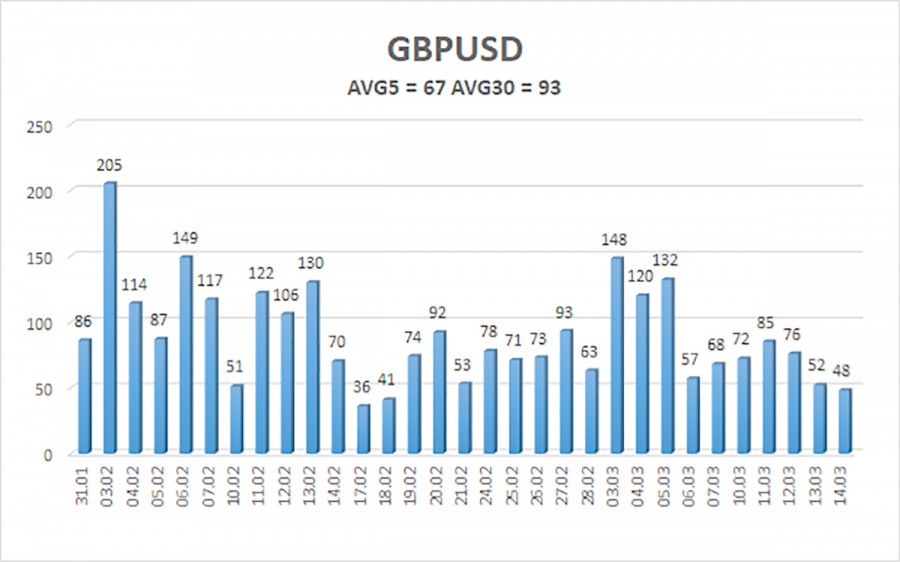

The average volatility of the GBP/USD pair over the last five trading days is 67 pips, which is classified as "moderate" for this pair. On Monday, March 17, we expect the pair to move between 1.2866 and 1.3000. The long-term regression channel has turned upward, but the downtrend remains visible on the daily time frame. The CCI indicator has recently avoided both overbought and oversold zones.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

Trading Recommendations:

In the medium term, the GBP/USD currency pair is maintaining a downward trend. We do not recommend taking long positions at this time, as we believe the current upward movement is merely a correction that has developed into an illogical, panic-driven rally. If you trade purely based on technical analysis, long positions are possible with targets at 1.3000 and 1.3062, provided the price remains above the moving average line. However, sell orders remain far more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily time frame will inevitably end sooner or later. The pound appears extremely overbought and unjustifiably expensive, but ongoing factors, such as Donald Trump's influence, continue to weaken the dollar. It is challenging to predict how long this depreciation of the dollar, influenced by Trump, will last.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.